Systems of Work Are Eating Systems of Record

How agentic reasoning is ushering in a new era of AI-Native apps

Context

A year ago, Chris Paik controversially wrote about The End of Software, arguing that it’s easier than ever to build software so there’d be a Cambrian explosion of new tools.

We’re not quite there yet but any early stage investor will tell you that it sure feels that way. Categories where a couple years ago you’d see 2-3 players now easily have 10-15 new entrants. Play the tape forward from here, and the markets shrink, prices compress, and spaces commoditize.

So the question remains – is there enduring venture scale value left in the application layer?

Where Value Was Created in the SaaS Era

We all know how hard it is to go up against an incumbent – especially if it requires a “rip and replace” of existing systems. No matter how crappy the customer service or the UI/UX looks, inertia is a powerful force. Better products lose everyday.

While provocative, Chris’ argument misses the mark of how challenging it is (and has always been) to build true enterprise-grade software. It requires:

Performance at scale - the ability to handle truly large workloads across a large user base with little to no downtime

Compliance & security - robust access management, detailed audit trails, adherence to data security standards / best practices

Change management & ecosystem lock In - integrations into other business systems, data lock in (esp true for systems of record), and an ecosystem of trained (oftentimes officially certified) employees, consultants, and integrators that raise switching costs

Customization & configurability - long implementation cycles that tune a baseline product to the exact needs of the customer

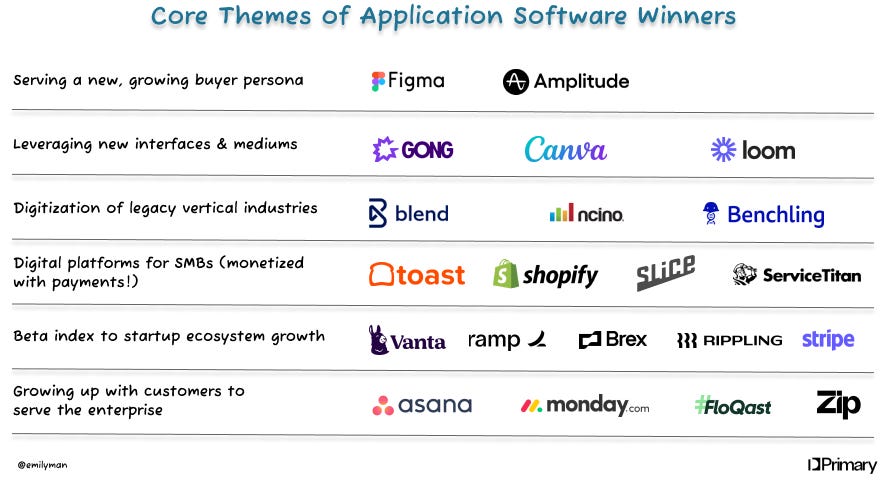

Even through the 2010s, and the “Era of SaaS”, many traditional enterprise heavyweights remained largely “undisrupted” despite many attempts and challengers who built 5x even 10x better products. Looking back at the winners that emerged in this era, there’s a couple of core themes:

These tailwinds have created $Ts in enterprise value but are largely mature. As a result, in the last couple of years (pre-AI), new entrants were increasingly forced to attack narrower customer segments or smaller niches to compete.

The AI Era Changes the Paradigm

AI changes this. The stage is now set for a new generation of truly enterprise grade AI-native software winners to emerge. These companies have the opportunity to completely reimagine workflows and categories from first principles and ultimately finally unseat the old guard.

Here’s how:

GenAI erodes traditional software moats: GenAI loosens many of the traditional characteristics of SaaS stickiness. With AI, it’s easier to extract critical data, quickly customize settings, and integrate into an existing ecosystem of tools. Spaces that traditionally would see 6-12 month implementation periods requiring a massive IT lift to get a new system live will see those shrink.

“Systems of work” will eat “systems of record”: If the atomic unit of the SaaS era was the record, the atomic unit of the AI era will be the work. AI agents have the ability to handle messy unstructured data and navigate complex decision making. Capturing that “process” of how and why a decision is made contains 10x more information than what decision was made. In this world, “end-to-end process” data becomes more valuable than “final decision” data. Owning the rails of the ‘sausage making’ becomes more valuable than the completed ‘sausage’.

AI allows for building 100x better outcomes: many SaaS 2.0 challengers were prettier, faster, and cheaper, but at the core, fundamentally the same. Incremental ROI led to indifference. New enterprise AI solutions can unlock jaw dropping experiences and value that is orders of magnitude stronger than their predecessors.

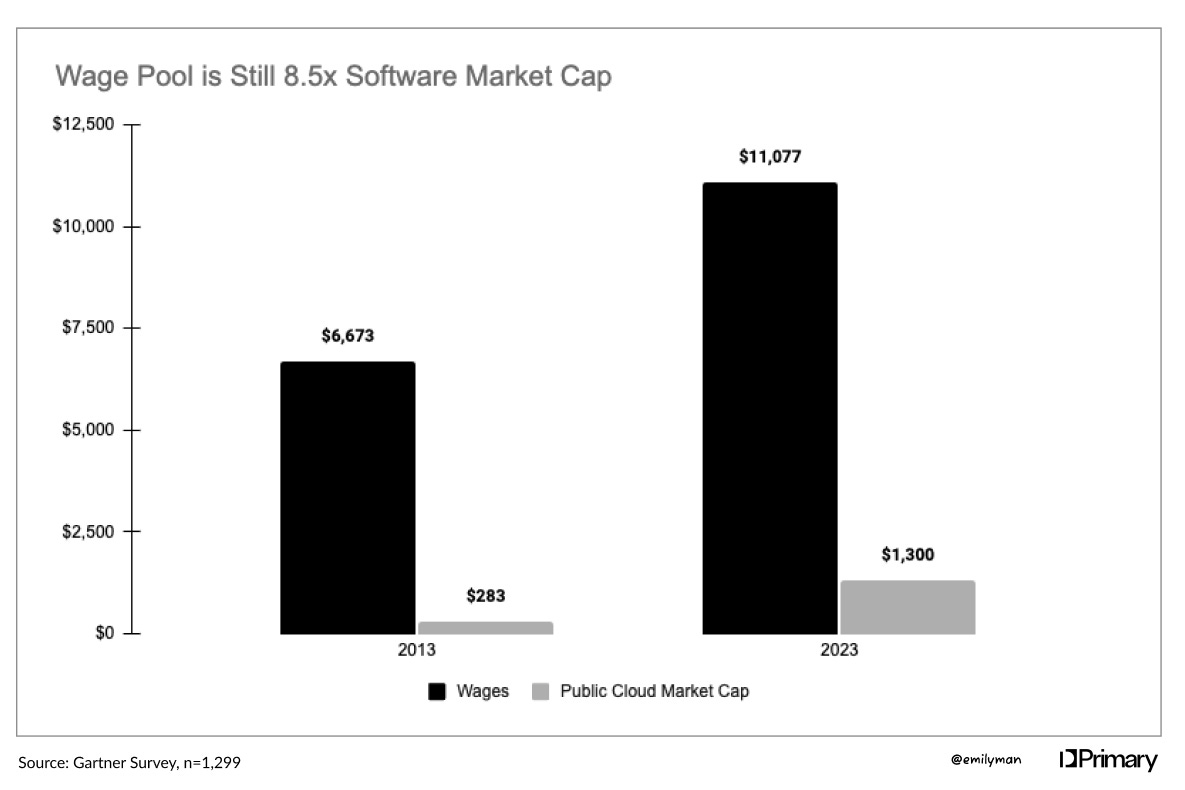

“Selling work” taps into a net new budget pool: No longer tethered to “seats”, this category of enterprise AI companies can directly replace human capital and tap into budget earmarked for people – whether that’s internal headcount or outsourced services. It also opens up downmarket segments by expanding attainable ACVs and opening up segments that were previously “not worth it” for system of record type companies to sell into given cost to serve + lower contract sizes.

Winners in the AI-Native apps won’t just replace software, they’ll also replace:

Spend on existing software tools (not sufficient on its own)

Outsourced spend (e.g. BPOs, consultants, third-party providers)

Internal white-collar headcount (the holy grail)

Source: “SaaS Isn’t Dead (Yet) and AI Could Make it Bigger”

Why Startups Win

Objection 1: So why is this not a giant race to the bottom?

The answer lies in the capture of reasoning logic: how decisions are made, not just what decisions are made.

The last generation of solutions focused on outcomes (e.g. issue refund or not). Now, with more and more work being taken on by agents, the process by which decisions are made is infinitely more valuable (e.g. see request >> analyze customer inquiry data >> cross check against internal policy >> apply human judgment >> make decision).

Put plainly, the capturing of how and why decisions are made natively in the workflow is the key. End-to-end feedback loops helps agentic products continue to make better decisions in the context of the customer they serve. This customer-level fine tuning of preferences and decision making, when done right, creates stickiness and lock in.

This is really just another form of data capture. Historically logs and actions were captured for audit and explainability purposes but now how a decision is made is becoming equally as important as what decision is made. This means that many categories are a land grab to capture reasoning logic and lock up customers quickly.

Objection 2: But don’t the incumbents have an inherent distribution advantage? Aren’t they just going to win?

Another common criticism of AI upstarts – i.e. why isn’t Figma the AI Figma?

In some categories this will be true: scaled winners of SaaS 2.0 that are nimble and capable enough to deliver an AI-native experience have an upper hand.

This is not true across all categories. AI-native startups can win in a couple of scenarios:

Going upstream into the “system of work”: many legacy “system of record” solutions enter at the end of the work being done. These solutions capture the result but not the process to get there.

Building guardrails for non-deterministic processes: LLMs are inherently non-deterministic. Harnessing their power while also developing the appropriate guardrails for accuracy and consistency is a new skill set that many traditional modes of software development are not well equipped to handle

The good ol’ innovators dilemma: traditional software monetization is tethered to seats and the expansion of those said seats. Agentic efficiency oftentimes runs counter to the core cash cow creating organizational conflict and difficulties prioritizing.

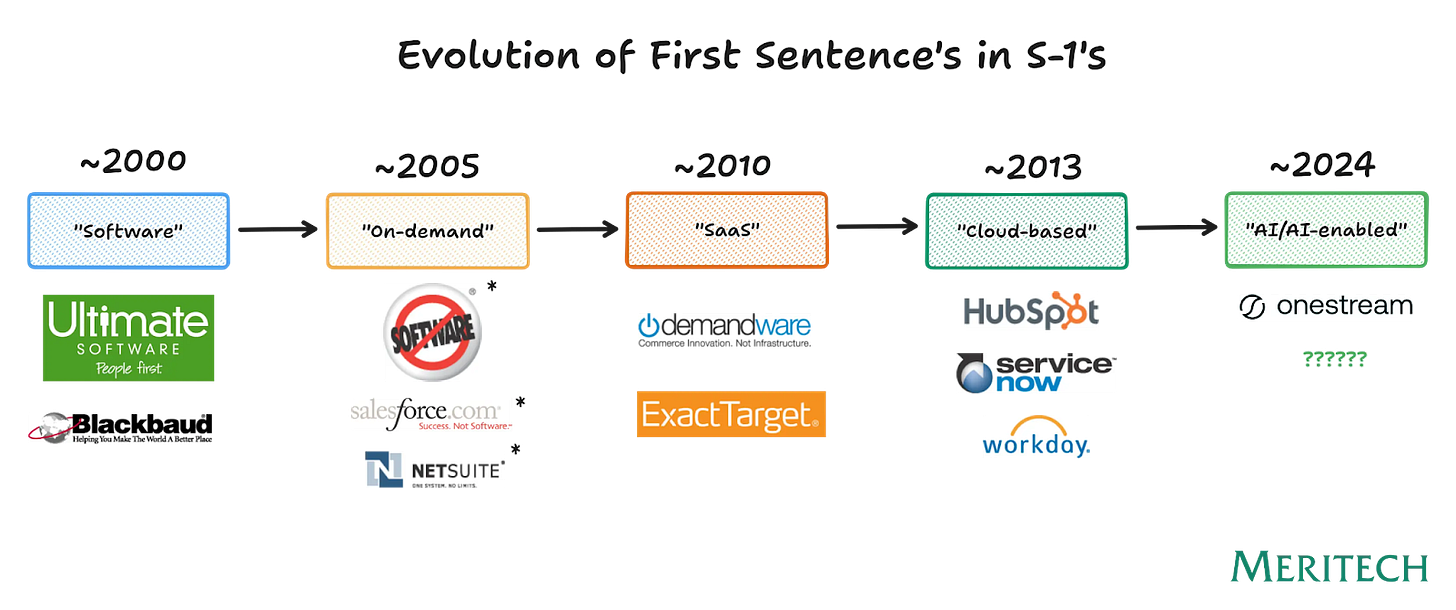

There’s parallels that can be seen from the shifting of software from on-prem to cloud (h/t to our friends at Sequoia)

Twenty years ago the on-prem software companies scoffed at the idea of SaaS. “What’s the big deal? We can run our own servers and deliver this stuff over the internet too!” Sure, conceptually it was simple. But what followed was a wholesale reinvention of the business. EPD went from waterfalls and PRDs to agile development and AB testing. GTM went from top-down enterprise sales and steak dinners to bottoms-up PLG and product analytics. Business models went from high ASPs and maintenance streams to high NDRs and usage-based pricing. Very few on-prem companies made the transition.

The ways “AI-Native” applications are designed, implemented, and tested will all have to change. For many incumbents, the cultural and structural leaps will be insurmountable.

Three ways the pie grows

There are three buckets of opportunity that we see in the application layer:

Democratizing access downmarket: By selling work vs. tooling, AI agents make services and functions that previously were inaccessible to smaller organizations affordable and easy to access for the mid-market and SMBs. For example, phone answering/customer inquiry, scheduling, customer support, inventory management, etc.

Vertical-specific use cases: Industries that require deep specialized knowledge have historically been under-penetrated by software solutions and have instead relied on expensive, highly-specialized labor. Previously, selling SaaS tools into these segments was considered too niche and markets too small. Agentic workflows that replace high-cost basis white-collar work and marry that with deep vertical and functional knowledge can make niche markets venture-scale

Productizing the “messy middle”: Workstreams that previously lived across systems and modalities (emails, spreadsheets, voice, etc) can now be codified into agentic workflows that the last generation of RPA tooling was not flexible enough to unlock. Because agents can tie together structured and unstructured data sources they’re able to finally productize the “work” that historically was manual.

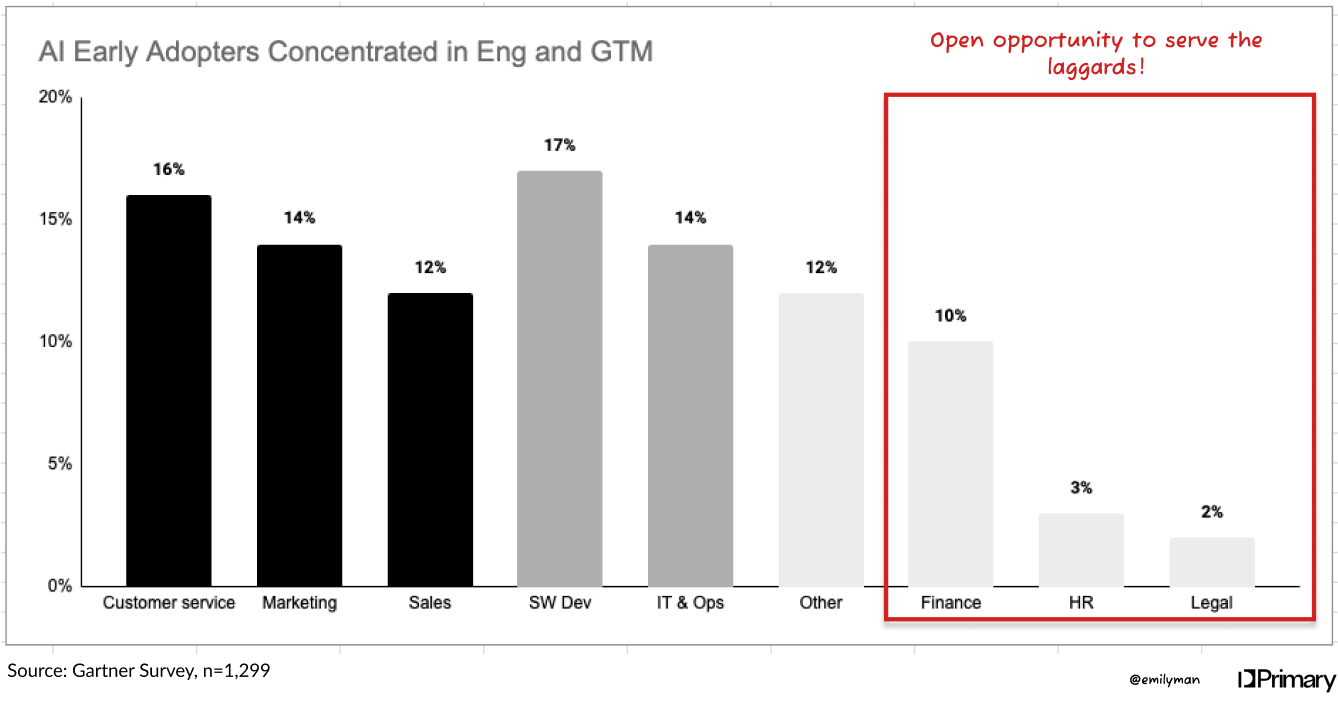

Going head on with incumbents at enterprise scale (bundled): Each functional department is being reimagined with an AI-Native solution. While we’ve seen strong early market traction in customer-facing functions (e.g. sales, marketing, support), there remains a lot of low hanging fruit in traditional “cost centers” that historically were not prioritized in terms of budget, IT resources, or attention to 10x those functions.

Why “Enterprise”?

This window of opportunity is largely specific to enterprise-grade applications because enterprises still need functional best of breed solutions. In the enterprise, enduring value will come from the intersection of:

Lowering of traditional enterprise software moats

10x improvement in value and ROI calculations

Relatively high implementation costs (with the “FDE” quickly becoming the hottest job category)

Continued need for enterprise grade permissioning / access management / compliance features

While there are many SMB and mid-market pain points that are very much worth tackling, the value creation drivers in those segments differ significantly from enterprise. More on that soon.

What are we looking for?

Low NPS incumbents: Either a) software markets where there is a large, universally-hated incumbent and the pain of rip & replace historically fended off new entrants OR b) services markets where spend (and varying quality) largely outpaces value delivered

Enterprise-grade core product: while this may require longer upfront build times, having a truly enterprise grade product will be a necessary criteria to be a contender for market winner. While we will not rule out companies that start in the mid-market to get a product to market – we need to see an end vision (and the product chops) to eventually serve enterprise

Capture of end-to-end workflows: Most importantly, the product must be set up to capture and learn from full cycle feedback, strengthening the “agentic reasoning” architecture over time. Solutions that do not capture “outcomes” will be non-starters.

Early enterprise credibility teams: the ability to get an enterprise customer to take a leap of faith on an early market entrant and product is nearly a moat itself (e.g. Brett Taylor at Sierra, Amanda Khalow at 1mind). We’re looking for teams that occupy the intersection of being 1) AI-native and 2) Day 1 credible with enterprise buyers. Given the long lead and deployment times, unfair advantages are needed to get the first points on the board.

We are at a juncture in time where every piece of software is being reinvented for the agentic era. The journey will not be easy— build times will be long, and revenue growth will be lumpy. But the long term path to value creation is clear. Here are specific areas that we’re actively looking to invest in:

“Offices of G&A”: Every horizontal middle/back office function (finance, IT, HR/payroll, benefits, legal, audit/risk, compliance, investor relations, etc) can be totally reinvented. Is there room for an AI-Native Workiva / Auditboard or next-gen Jira?

Future of work 2.0: Collaboration and productivity software that is designed for a hybrid human + AI agent workforce. As the balance shifts over time, new tooling will be needed for coordination of activities whether that is agent <> agent or agent <> human, particularly when it comes to cross-functional work.

Vertical “systems of work”: Are there more industries with a defined universe of buyers that are overdue for their own “Veeva” that to date have been retrofitting horizontal solutions for their needs? We’re actively looking for solutions across insurance, energy, government, and more that are creating the “systems of work” that add intelligence to core systems of record.

If you’re building the next-generation of enterprise AI, I’d love to hear from you.

If you’ve been following along for a while, you’ll notice I’ve rebranded from “Fintech FWD” to “FFWD” as I start to explore more themes along this foundational thesis!